Which bank serves the "Corn" card? How to make and replenish the credit card of "Corn"?

A good analogue of a bank loan for a whilemaking overseas trips can serve as a credit card. If you repay the debt in a timely manner, you can use the money unlimited number of times. Previously, they were issued only by banks. Today in Russia, "Euroset" and "Svyaznoy" offer to issue such a plastic payment instrument. More details about what kind of a bank "Corn", which bank it serves, you will learn from this article.

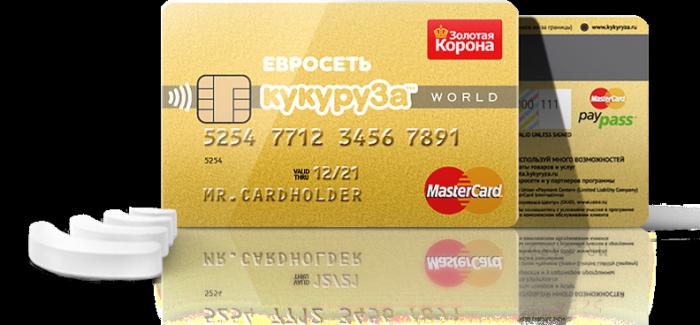

Decor

You can buy the card through the branch of Euroset,"Connected" or in the drugstores "Doctor Stoletov". Only the passport and money will be required for registration. There are two types of cards in circulation: regular and World. The first costs 200 rubles and allows you to accumulate 1% of all purchases. World issued free of charge, but the balance should immediately enroll 3000 rubles. and spend it. Owners of these cards will be able to accumulate 1.5% of each purchase. Through the network of pharmacies "Doctor Stoletov" you can get only a regular card.

The registration procedure takes 5 minutes. Immediately after it is completed, a SMS with a code word is sent to the user's phone. It must be used for all calls to the Call Center, including for getting a PIN. The map is not named. It can be taken abroad. But it is possible that in the calculations in local stores there will be problems. Therefore, it is worthwhile to order personal plastic.

First, customers receive a debit card. Having it in your hands, you can apply for a credit limit. Each of the five financial institutions in Russia has its own terms of service for such a product as the "Corn" card. Which bank is better, each client determines independently.

Offers

Cards work similarly to other credit cards. Money can be withdrawn in cash at ATMs, transferred to other accounts, paid by cashless method of purchase on the Internet and in outlets. Among the additional features is a bonus account: 1-1,5% of all money costs are converted into special points. They can then be used to pay for goods in stores: 10 bonuses = 1 ruble. Regardless of which bank serves the "Corn" card, you can use points only at the same points in which they were accumulated. These are Euroset, Svyaznoy, Perekrestok, the Stoletov drugstore chain and TNK refueling stations.

The feedback on the "Corn" bonus card confirms,that such a scheme is not entirely convenient. Not all customers buy goods monthly at cell phone shops. Experts recommend using bonuses in pharmacies or saving them a whole year, and then 2-3 times free refueling.

Money transaction

One of the drawbacks of this type of card islimited ways to replenish the account. Money can be credited to the balance only with a personal presence in the offices of Euroset, Svyaznoy or TNK stations. Users can transfer funds to each other through the "Personal account". Here you can also attach another card issued by Mastercard and transfer money from it instantly. Without commissions, transactions take place only with plastic payment instruments of Sberbank and Tinkoff. Here is how to issue and replenish the credit card of "Corn".

Withdrawal of funds

"Corn" - not an ordinary card. To withdraw funds from it without commission, you need to use the loan repayment function through the "Personal account" in the menu "New payment". There you must specify the number of another Mastercard debit card and transfer money to it already.

Terms of financial organizations

On the debit card "Corn" you can connectcredit limit. But since shops can not independently provide loans, partner banks and microfinance organizations were involved for this purpose. Let us consider their conditions in more detail. Regardless of which bank serves the "Corn" card, the requirements for customers are almost the same:

- citizenship of the Russian Federation;

- presence of a place of work and constant earnings;

- the borrower's age ranges from 21-25 to 57-64 years.

- for issuing a loan, you must provide a second identity document.

Home Credit Bank provides customers witha credit line for a period of 6 to 36 months at a maximum amount of 50 thousand rubles. at a rate of 46.9% per annum. In "Alfa-Bank" loan of 40 thousand rubles. can be obtained for one year at 44% per annum. Commission for service is much higher than for standard cards. In addition, the bank meticulously checks documents and does not always approve applications. If a refusal has come, and you still need to issue a card, you can apply to MIGCredit. Organizations provide a loan of 20 thousand rubles. for a period of 4-24 weeks, provided that the account will be replenished every 2 weeks. This scheme is not beneficial to every client. Especially when you consider that the interest rate in such institutions is 2 times higher than the banking rate.

Other offers

"Tinkoff Bank" offers its customers more interesting conditions:

- interest rate: from 28.9 to 36.9%;

- the limit is 300 thousand rubles;

- grace period-55 days from the date of the first withdrawal;

- service charge - not applicable;

- cashing out of funds: 1% of the amount, at least 100 rubles;

- Penalties in case of delay in payment: 0.2% of the amount for each day, one-time commission - 590 rubles;

- the minimum monthly payment is 6% of the debt amount.

Which bank serves the map of "Corn" onsimilar conditions? "Renaissance". Credit limit and grace period in this organization are similar to the previous one. The difference is in the interest rate (24-79.9%), commission for cashing of funds (3-4%) and higher penalties. For violation of payment terms, the client will have to pay 20% of the sum of the debt. The minimum monthly payment for the terms of the program is 5%, but not less than 600 rubles. For connection of SMS-informing service for a year it is necessary to pay 750 rubles.

Conversion

It is separately worth negotiating the payment of goods inforeign currency. Regardless of which bank serves the "Corn" card, currency conversion will occur two times at the rate of the Central Bank. The first is on the day of purchase. The amount of the goods will be blocked in the account +2%. When paying for services in foreign currency, money is not always written off from the account on the day of purchase. Most often, it takes 2-3 days for a foreign bank to confirm the transaction. Therefore, the second conversion of funds will occur at the time of writing off.

Example

The man paid for goods worth $ 100. On this day the rate was 35 rubles. The account will be blocked: 100 x 35 + 2% = 3570 rubles. After 48 hours, confirmation came from a foreign bank. The rate of the Central Bank on this day is already 35.1 rubles. From the account will be written off: 35.1 х 100 = 3510 rub. The difference of 60 rubles. will be returned to the account. Many credit cards work on this scheme, including the "Corn" card. Which bank serves the client, in this case it does not matter. The procedure for debiting funds is the same.

The second nuance: regardless of the currency in which the value of the goods is indicated, rubles will be debited from the account after preliminary conversion into dollars or euros.

Conclusion

Russians have the opportunity to purchase goods incredit, without waiting for a salary and not saving money for a long period of time. For these purposes, a special map "Corn" is provided. Which bank serves it in Russia? Alfa-Bank, Renaissance, Tinkoff, Home Credit. The client can choose any of them independently. The product has a number of advantages: a small package of documents, an application can be issued online, the minimum requirements for borrowers. But to insure their risks, banks have provided higher interest rates for card servicing and penalties for violation of the maturity of the debt.

</ p>