All about TCB for OSAGO

On the roads of our country travels a huge amountVehicle. It's not a secret for anyone that different situations can happen during this, including an accident. Therefore, the owner of the car must have insurance.

Any driver encountered a problem whenattempt to receive insurance payment, the insurer refused to grant payment due to the loss of the commodity value of the vehicle. Most of all with a similar situation, owners of expensive cars face, which can lose up to 30 percent in their cost. In order not to get into a difficult situation, every driver should know how to get TCB for OSAGO.

Despite the fact that the activities of insuranceof companies is regulated by law, nevertheless there are a lot of pitfalls in it, which give many options for loopholes to unscrupulous insurers. As practice shows, you can solve the issue of insurance payments through court, but not all motorists know how to do it.

general information

Despite the fact that in 2017 manymotorists have gained good experience in combating the lawlessness of insurance companies through litigation, however, inexperienced drivers often face various problems when going to court. According to the current legislation, compensation is only real damages received as a result of the accident, and after performing the repair of the car, it ceases to be such. So how do you get compensation in full with TCB for OSAGO?

In what situations is the payment of TCB supposed?

Immediately it is worth noting that you can not get a payment for the loss of the commodity value of the vehicle in all cases.

For this, several criteria must be met:

- not to be the culprit of the accident;

- the amount of damage received should not exceed 400 thousand rubles;

- the age of the vehicle must not exceed 5 years, if the car is foreign manufacture, and 4 years - for Russian cars;

- The wear of the machine should not be more than 35%.

It is worth noting that the conditions for the payment of TCB byOSAGO are similar, as for CASCO. Therefore, if you do not satisfy at least one of the listed points, then you can not count on the payment of monetary compensation.

How is TCB calculated?

To determine the exact size of the loss of transportcost of the machine, it is best to contact an independent company specializing in this matter. After the completion of the examination, the company issues a document that specifies the exact amount of repair taking into account the technical condition of the car.

How to get a payment on TCB?

The main problem of obtaining an insurance payment forTCB is that insurers, by law, are not required to produce them. All SCs refer to the law, which states that only real damages resulting from an accident are liable to compensation. Therefore, before applying to the court, it is necessary to understand whether there is any sense in bringing the case to trial. It is very easy to determine this if we compare the current market value of new and broken machines of the same brand.

Next, you must perform the following steps:

- submit to the insurance company a statement of TCB for OSAGO, a sample of which can be obtained from the insurer;

- if the UK refuses to compensate for the damage, it is necessary to undergo an independent examination of the estimated repair work performed;

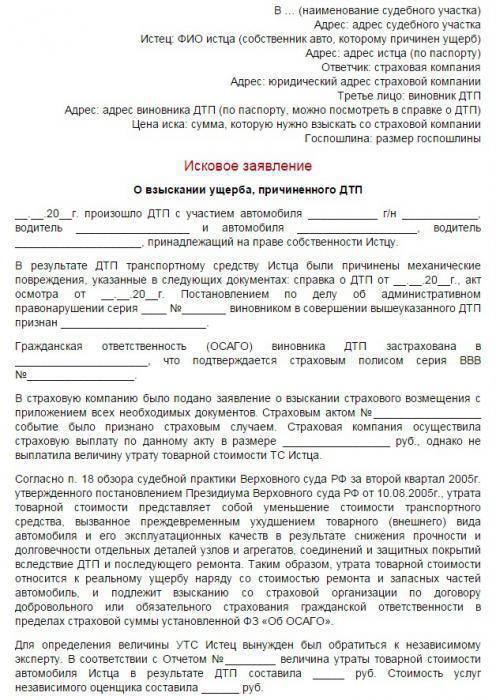

- prepare a statement of claim and the necessary package of documents for the trial.

As practice shows, in most cases, courts take the side of a motorist.

Applying

In most cases, a statement of claim is filed, so do not expect that at sight of it, the insurer will immediately satisfy your claim for compensation.

What documents will be needed?

Making up the compensation for TCB for OSAGO, the application to the insurance company must be submitted together with the following documents:

- original and copy of passport;

- driver's license;

- insurance contract or policy;

- a copy of the application and claims that were presented to the insurer during pre-trial proceedings;

- receipt of payment of state fee;

- documents for the vehicle: a technical passport, a certificate of registration, a ticket for passing a vehicle inspection;

- documents from the State Traffic Safety Inspectorate: a copy of the certificate of fixation of an accident, a protocol, a resolution or refusal to initiate a case, and others;

- a copy of the notification of a traffic accident;

- a copy of the document confirming the occurrence of the insured event;

- the conclusion of independent appraisers about the cost of repair work;

- technical inspection report;

- a report on the amount of loss of the commodity value of the vehicle;

- a contract concluded between the owner of the car and an independent expert;

- copies of claims for each of the defendants in the trial.

This package of documents is mandatory for the transfer of proceedings to the court.

Collection procedure

The recovery of TCB for OSAGO occurs in the following order:

- Submission of application to the insurer requesting payment of monetary compensation.

- Waiting for an official response from the insurance company about the satisfaction of your request, which must come to the post by registered mail.

- Self-assessment of the probability of compensation for TCB.

- Appeal to independent experts to assess the real cost of repairing a vehicle.

- Submission of an application to the insurance company with a demand to pay compensation for the lost value of the car in full.

- If a refusal to pay compensation is received, a claim is made to the CEO of the insurance company.

- If the claim is also rejected, then a lawsuit is filed with the court.

Only by following this scheme, you can get compensation for the lost commodity value of the vehicle.

Who pays for TCB

If in the calculation of TCB for OSAGO was established,that the cost of repair work exceeds 400 thousand rubles, which is obligated to pay the SC under the current legislation, the compensation of the remaining part of compensation falls on the culprit of the incident.

Penalty

To date, a separate provision onpenalty in the event of a delay in compensation for the loss of the commodity value of the car is not provided, and any problems associated with it are resolved in a standard manner. Thus, the amount of the penalty will be determined by the principle, as in the case of delay or refusal to fulfill the obligations imposed by the court.

If during the trial the insurancethe company will be obliged to pay compensation for TCB, but the insurer will delay payments, then for each day of delay, a fine of 1% of the repair cost will be imposed on it. For compensation of TCB for OSAGO, the UK has 20 calendar days.

When repairing the service station

It is important to understand that no insurervoluntarily will not go to compensation for damage, so this problem will have to be solved through a court of law according to the standard scheme that was described earlier. Do not be afraid of litigation, because, as practice shows, in most cases the insured defeats them.

But only those motorists can expect to receive payments, the level of depreciation of which does not exceed a certain threshold. For CASCO policies, it is no more than 35 percent, and for OSAGO 40%.

A few tips and recommendations for getting TCB

The process of receiving payments when the loss of commodityof the cost of the machine is very complicated, as it goes against the interests of the insurance company, which will try to deny them to the client in every possible way. In this article, a step-by-step instruction has been described in detail, observing which, it is possible to obtain compensation for damage.

Here are a few more general tips and recommendations that will be useful for drivers who have encountered TCB:

- If the amount of damage suffered by TCB exceedsthe limit of insurance payments specified in the contract, then the rest of the amount can be recovered from the person whose fault caused the traffic accident.

- Under the category of insured events with TCB, accidents resulting from a collision with green spaces and some types of buildings also occur.

- According to the new changes in the legislation, damages can be compensated for by TCB in the event that the car was harmed at the hands of hooligans not only on the roads, but also in the yards.

- If the accident was recorded with the help of the European protocol, the compensation for damage on the TCB can be obtained if there are photos and videos from the scene.