How to calculate interest on a loan

Most people sooner or later turn tolending, because it is much easier to take money in debt at interest than to ask a significant amount from friends and acquaintances in debt. In our life, sometimes events occur, it is difficult to prepare for it in advance, and the money put aside for a "rainy day" is not enough. Having read terrible stories in newspapers, when banks take away their apartment, car and last shirt for debts, most people try to prepare in advance for a trip to the bank. Having learned all the details of the loan in the bank, you can try to independently answer the question "how to calculate interest on the loan" and find out the size of the future overpayment.

Almost all banks are currently issuingloans where monthly payments are annuity, that is, in the payment schedule the amounts do not change. Any payment consists of the amount of principal and interest on the loan (if there are no additional monthly commissions). At the very beginning of payments in the amount of monthly payments, the percentage of interest is higher, and then it gradually decreases, and payments on the principal debt, respectively, increase. Sometimes, along with annuity payments, differential payments are applied, when the amount of monthly payments gradually decreases. So, how to correctly calculate the interest.

How to calculate interest on a loan.

In each annuity payment there is necessarily an annuity coefficient, all further parameters of the loan depend on it. In order to calculate the coefficient, the following formula is applied:

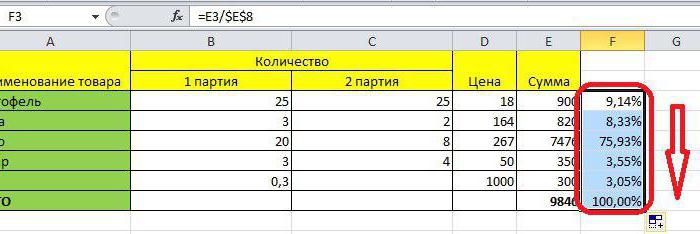

AK = KP * (1 + KP) N / ((1 + KP) N-1)

AK is the annuity coefficient;

KP - the interest rate coefficient

N - loan repayment period in months

KP or the interest rate coefficient can be calculated by the formula:

KP = PS / 1200, where the PS is the annual interest rate advertised by the bank.

Now it is quite easy to calculate the amount that you will need to pay the bank monthly.

Monthly payment = Annuity factor * Loan amount.

Now let's calculate the total amount of debt, that is, the amount that you will have to give to the bank for the entire loan period.

Total loan value = Period in months * Monthly payment for the loan.

Well, now, since we asked ourselves how to calculate the interest on the loan, we will calculate the amount of the overpayment for the loan:

Overpayment on loan = Total amount of loan payments - Loan amount

Now you can easily plan your family budget and spending on a loan, because for you now is not a secret, how to calculate interest.

Effective interest rate.

I would like to note one important point. You must clearly understand what you mean when you are trying to figure out how to calculate interest on a loan. In addition to the annual interest rate in the bank, you can voice an effective interest rate. This rate includes all other overpayments on the loan plus the annual interest rate. This rate is much closer to reality than the usual annual rate on the loan.

Now a few words about the annual percentage. There are such concepts as a simple and complex percentage. Compound interest is charged on the extended amount of the loan plus past accruals. Simple interest is accrued on the initial amount. So the annual interest is a compound interest, and it can not be calculated if you take the original loan amount. Why not? Interest is charged each month to the balance of the principal, not to the entire amount, and the accrual is made on the principle of annuities.

Do not hesitate in the bank to ask for an approximate schedulepayments and compare the total amount of the overpayment with the one that you received. And do not forget to add to the calculations of the total loan amount all the amount of commissions and insurance that the bank will certainly take from you.

</ p>