The "garbage" rating is what? What awaits Russia after the "garbage" rating

Today in the media every now and thenthe reports about the assignment of Russia to the rating with a specific name "junk" rating are slipping. This definition for many remains incomprehensible, because an ordinary person may not understand financial terms well, and if the rating is more or less clear, then such jargon expressions as "garbage" need to be told in more detail. About this and other topical issues from the field of the economy later in this article.

What it is

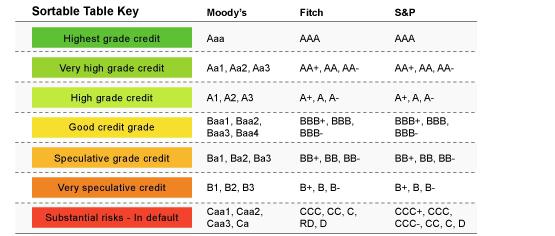

To understand what the "junk" rating means,First of all, it is necessary to understand the definition of "credit rating". Any individual, company or even a country can have its solvency rating. For example, in most cases banks form their own borrower ratings, and when it comes to assessing the soundness of large corporations or states, specialized independent rating agencies are engaged in this. Among them are FitchRatings, Moody's and Standard and Poor's (S & P), whose activities extend to the whole world, and to their opinion most investors listen.

In relation to the states, these indicators are compiled on the basis of an analysis of the economic situation, the exchange rate of the national currency and other indicators.

It can not be said that there is some generally acceptedrating system, each agency has its own methods and indicators. All estimates can be conditionally divided into obligations of the highest, highest, average quality. Further, there are risky and speculative guarantees, as well as forecasts for an early default. The "garbage" rating is a commitment of just this type.

Causes of the crisis in Russia

Although in recent years, Russia's credit rating is notwas at a high level, but it was not a "garbage" and in the solvency of the country there was no particular doubt. Problems began in 2014, after the accession of the Crimea and subsequent sanctions from the US and the European Union. All aggravated by the fall in oil prices, which provoked a significant devaluation of the ruble. These and other events gave rise to talk about the crisis and even the possibility of a default in Russia.

Countries with a "junk" rating usually have a weakeconomy with numerous problems. Now the international community has seriously started talking about bringing Russia on this unpopular list. By the way, the last time the country's credit rating was at the level of "junk" in 2005.

Pessimistic forecasts

At the end of 2014, former Finance Minister Alexei AlexeyKudrin said that a full-fledged economic crisis is beginning in the country. According to him, Russia in 2015 may well be given a "junk" rating, this will be caused not only by low oil prices - sanctions also provoke a recession in the economy. According to the forecast of the former head of the ministry, the country's GDP will be reduced by at least 2%, provided that oil will cost $ 80, at low prices around $ 60, the economy may fall by 4%.

Kudrin also believes that the government is pursuing an inadequate policy, so that low or zero growth rates are inevitable even without external difficulties related to oil prices and sanctions.

Rating downgrade

At the beginning of 2015, Fitch reducedassessment of the solvency of Russia to the level of BBB-, which is the last step in the investment zone, then the "garbage" rating goes on. Russia was given a negative outlook for the near future.

Soon after, the rating agencies S & P andMoody's lowered Russia's credit rating to speculative or so-called "junk." According to their reports, one of the reasons for the decline in estimates is the ongoing conflict in Ukraine, which, one way or another, can affect the economic situation in Russia itself. Negatively affected by low oil prices and the unstable exchange rate of the national currency.

The agency Moody's, among other things,that there is a likelihood that the Russian government will take such decisions, which in one way or another may affect the servicing of the country's foreign debt in due time.

It is worth noting that if the estimates of different agencies differ, then the worst forecast is taken into account first.

The objectivity of estimates

The rating agencies of the "big three" areindependent institutions, their evaluations are considered to be unbiased and objective. However, the fact that agencies, one by one, appropriates the "junk" rating of Russia, is considered by the Ministry of Foreign Affairs as a political decision, unfounded from the economic point of view and aimed at weakening the country. The ministry is confident that such assessments are part of the Western policy of pressure on Russia through sanctions.

It is noteworthy that the decision of the agency Moody'sto assign Russia an estimate of Ba1, which just does mean a "junk" rating, Kudrin thought it was not clear, despite the fact that earlier he had suggested that the sovereign rating of Russia could be reduced to speculative. It is puzzling and the fact that before that rating was revised just a month ago - it is unclear why this is needed right now.

Than it threatens the country

By itself, "trash" rating is not much threatening,the more so because the economy is more influenced by such major factors as the price of oil, the ruble exchange rate, as well as the creditworthiness of companies and the public. We can say that the low rating reflects the existing difficulties.

Countries with a "junk" rating may experiencedifficulties in obtaining loans abroad, and in the case of Russia, given the sanctions imposed on it, the low ratings of agencies will change little - the flow of investment into the country has declined significantly in 2014. However, many investment funds impose a ban on investing in the economy of states with a "junk" rating, so the inflow of foreign funds may decrease somewhat, but this is unlikely to become critical for the economy.

Talk about default

As for rumors about the possibility of default,they, of course, are an exaggeration and a panic. If we talk about low ratings, then to category D, which means a high probability of default, Russia is still far away.

The "garbage" rating is not a verdict, besidesthe external debt of the Russian Federation is not so great and amounts to just over 10% of GDP, while in other countries with a higher rating, public debt can exceed their GDP. If necessary, Russia can service its obligations at the expense of gold and foreign exchange reserves.

What does "junk" rating mean for Russia?

First of all, it should be said that the "garbage"the rating does not mean the country's final roll into the crisis pit. Against the backdrop of poor assessments of Russia's solvency, as well as low oil prices, analysts predicted a further fall in the ruble's rate and other problems in the economy. However, in the spring, the ruble appreciably strengthened against the dollar, and oil prices stabilized. The government takes appropriate measures to overcome the crisis.

For example, the "garbage" rating of Ukraine inreality reflects a deplorable state of affairs in a country whose economy directly depends on Western credits. In the case of Russia, everything can change. Sooner or later the situation will improve, and then the rating agencies will reconsider their estimates for the better.

</ p>