Power of attorney for representing the interests of the organization.

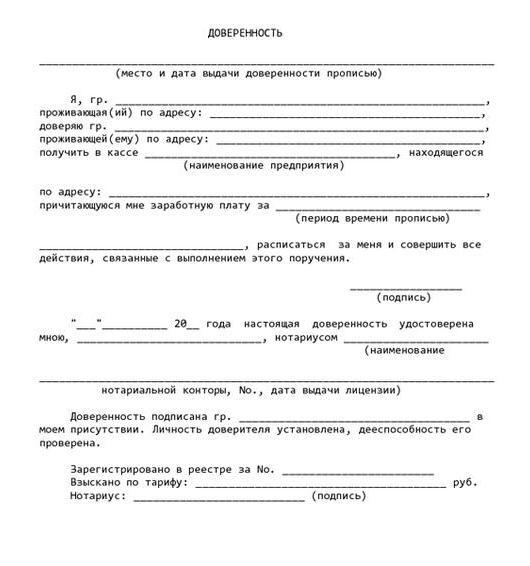

In accordance with the law, the officialthe representative of the organization, in addition to its head, can be any individual or enterprise having an appropriate power of attorney. The order of registration of these documents is regulated by law only in general terms and the organization can issue power of attorney of any form, certified by the stamp and signature of the director. Mandatory requisite is the date of registration, without which the document has no legal effect. The validity period can be any period of time not exceeding three years, if it is not specified, the power of attorney to represent the interests of the organization is valid for one year from the datedelivery. Also, when registering, it is important to completely indicate the passport data of a trusted person. The text of the document should not contain abbreviations, all numbers must be written in both numbers and words. Compliance with these rules will allow the trustee to avoid misunderstandings when presenting the document and perform the assigned actions in time.

Power of Attorney for representation of interestsan organization is issued to perform a one-time action (obtaining a document, concluding a transaction); regular fulfillment of homogeneous operations (submission of reports, receipt of correspondence). In addition, the employee may be issued a general power of attorney, which implies the transfer of all or most of the rights that the head has.

Power of Attorney for representation of intereststhe organization is not subject to mandatory notarization, except for cases when the employee is delegated the authority to dispose of the immovable assets and transport of the firm, the transfer of rights received, and in some other situations determined by law. It should be noted that the power of attorney issued to employees for making major transactions or representation in another city, as well as directors of branches is recommended to certify from a notary. This will serve as an additional guarantee for the legality of the actions of the trustee and will become a weighty evidence in court in the event of a problem situation.

The only power of attorney to represent the interests of the organization, for which a unified form is provided,is intended for obtaining material values. It is the primary accounting document and is mandatory for use. In addition to printing the company and the signature of the head, this power of attorney is also certified by the signature of the chief accountant.

The most common power of attorney to represent an LLC or joint-stock company is issued to employeesaccounting or an outsourcing firm to interact with tax authorities and off-budget funds. This document can transfer to the authorized person various powers: reporting, obtaining extracts from the Unified State Register of Legal Entities and decisions of tax authorities, presence during the examination of materials of desk inspections, etc. The power of attorney for the submission of reports must be presented not only in the personal accountant's address, but also when sending electronic documents through an outsourcing firm. At the same time, the document must be submitted to the tax inspection or extrabudgetary fund until the reports are sent. The methodological recommendations of the Federal Tax Service (Appendix No. 1) contain a form of power of attorney, which includes all the necessary powers.

A power of attorney issued by a legal entity muststrictly comply with the framework of the statute. There are also powers that the organization does not have the right to delegate to representatives. These include the transfer of taxes, compensation for harm caused and some others. It should be noted that, in accordance with the letter of the Federal Tax Service No. ShS-22-6 / 627, a power of attorney for representation of the interests of the IP is formalized in the manner provided for organizations (subject to the presence of a seal).

</ p>